Introduction

Art, beyond its aesthetic allure, has emerged as a formidable player in the world of investments. Beyond the traditional stocks and bonds, art investment offers a unique avenue for financial growth, adding a brushstroke of diversity to your portfolio. In this article, we’ll delve into the nuances of art investment, exploring the basics, the myriad benefits, and providing you with practical insights on how to build, protect, and grow your own art collection.

Investing in art goes beyond the potential for high returns; it’s about the joy of ownership, the cultural enrichment, and the thrill of being a part of the ever-evolving art world.

The Basics of Art Investment

Unveiling the fundamentals of art investment, this section elucidates the intricate dance between aesthetic appeal and financial acumen.

Art Investment Unveiled

A comprehensive breakdown of what art investment entails and how it operates within the realms of finance.

Art investment is not merely about acquiring visually appealing pieces; it’s an investment strategy that involves acquiring artworks with the expectation that their value will increase over time. Unlike traditional investments, the value of art is often subjective, influenced by factors such as the artist’s reputation, the historical context of the piece, and its cultural significance. Understanding the dynamics of this market is crucial for making informed decisions.

The Palette of Investment Choices

Delving into the various forms of art investments, from traditional paintings to contemporary sculptures and photography.

The art world is a vast canvas offering a plethora of investment choices. Traditional paintings, with their timeless allure, share the stage with contemporary sculptures that redefine artistic boundaries. Photography, often capturing poignant moments frozen in time, adds a modern twist to the palette of investment options. Each form comes with its unique set of considerations, and understanding these choices is paramount to crafting a well-rounded art investment strategy.

Evaluating Art’s Essence

Guidance on how to critically assess the quality of art, considering factors beyond aesthetics, such as historical significance and cultural impact.

Assessing the essence of art goes beyond visual appeal. It involves understanding the historical context and cultural impact of a piece. Knowing the artist’s journey, the societal milieu in which the artwork was created, and its contribution to the art narrative are crucial elements. This section guides you through the nuanced process of evaluating art, ensuring your investments are not just visually stunning but carry a depth that resonates with cultural and historical significance.

The Benefits of Art Investment

Highlighting the manifold advantages of investing in art, this section emphasizes the diversification it offers and the historical performance of art as an asset class.

Diversify and Thrive

Exploring the role of art in diversifying investment portfolios and its unique resilience compared to traditional markets.

Art is a diversification powerhouse. Its value doesn’t always correlate with the ebb and flow of stocks and bonds, providing a valuable hedge against market volatility. Understanding how art can act as a stabilizing force in your portfolio is key to harnessing its full potential.

A Brush with Returns: Art’s Historical Performance

Analyzing the historical performance of art investments and how they stack up against other financial instruments.

History tells a compelling tale of art as an investment. Examining past trends and performance metrics provides valuable insights into the potential returns of your art portfolio. This section delves into the historical data, offering a roadmap for understanding how art has stood the test of time in the world of investments.

How to Build an Art Collection

Dive into the art of building a collection, exploring diverse avenues and imparting practical advice on researching artists, negotiating prices, and avoiding pitfalls.

Navigating the Art Marketplace

Guidance on sourcing art from galleries, auctions, and online platforms, emphasizing the importance of a well-rounded approach.

The art marketplace is a dynamic landscape with various avenues for acquisition. Whether you prefer the ambiance of galleries, the thrill of auctions, or the convenience of online platforms, each option comes with its own set of advantages and challenges. Navigating this diverse marketplace is essential to curating a collection that aligns with your taste and investment goals.

Researching Artists and Artworks

Insights on conducting effective research to identify promising artists and artworks with the potential for appreciation.

Research is the backbone of any successful art collection. This section provides a roadmap for delving into the backgrounds of artists, understanding their artistic journeys, and identifying the factors that contribute to the value of their works. Armed with this knowledge, you can make informed decisions that align with your investment objectives.

The Art of Negotiation and Pitfall Avoidance

Practical tips on negotiating prices and avoiding common pitfalls when venturing into the art acquisition landscape.

Negotiation is an art form in itself, especially in the world of art. This section equips you with practical tips on negotiating prices with sellers, ensuring you secure artworks at a fair value. Additionally, it sheds light on common pitfalls, empowering you to navigate the market with confidence and discernment.

How to Store and Protect Your Art Collection

Securing the longevity of your art investment, this section provides essential guidance on proper storage, protection, and insurance.

Safeguarding Your Masterpieces

Emphasizing the significance of proper storage and care to protect your art from damage, theft, and other risks.

The journey doesn’t end when you acquire a piece of art; it extends to how you safeguard and preserve your treasures. This section delves into the importance of proper storage, considering environmental factors that can impact the longevity of your collection. From temperature control to lighting, every detail matters in preserving the beauty and value of your artworks.

Insuring Your Art Collection

A guide to navigating the world of art insurance and creating an inventory to safeguard your collection.

Art is an investment, and like any investment, it comes with risks. This section explores the world of art insurance, offering insights into the types of coverage available and how to choose a policy that aligns with your needs. Additionally, it emphasizes the importance of maintaining a comprehensive inventory, ensuring you have a detailed record of your collection for insurance and appraisal purposes.

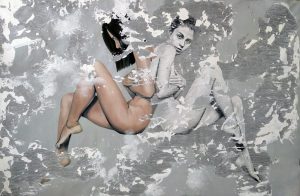

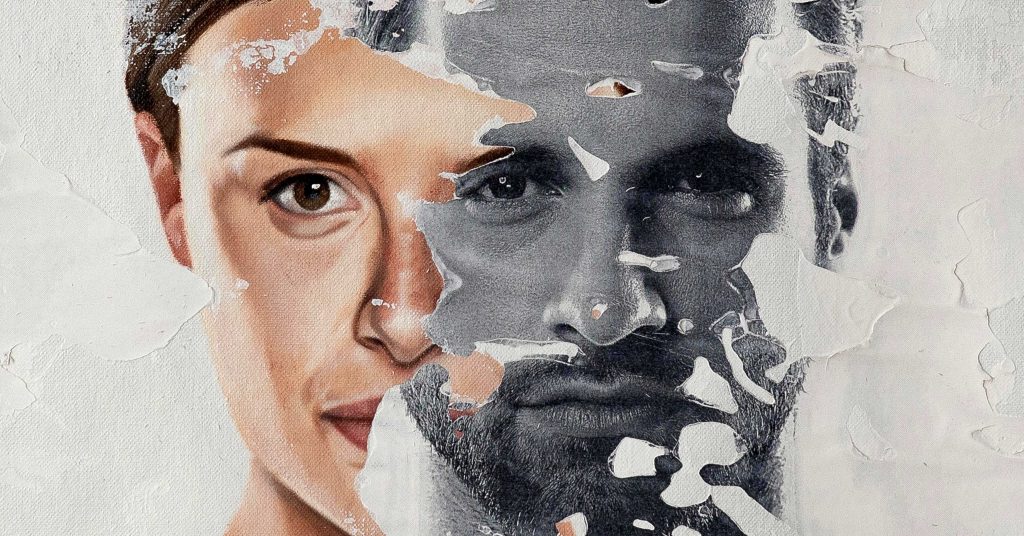

The Allure of Neophotorealism: A Unique Art Investment Opportunity

As we explore the world of art investment, it’s essential to keep an eye on emerging trends and groundbreaking techniques that redefine the art landscape. One such innovation that demands attention is Neophotorealism, a visionary approach introduced by artist Raúl Lara.

Investing in Neophotorealistic Art: A Distinctive Proposition

Neophotorealism stands out as a unique and promising avenue for art investment. This technique, born from the creative genius of Raúl Lara, combines the precision of photography with the expressive depth of traditional oil painting, resulting in artworks that are not only visually captivating but also hold the potential for appreciation in value over time.

The Unparalleled Realism and Expressiveness

Neophotorealistic artworks offer a new level of realism, depth, and texture, achieving heights of expressionism that were previously unattainable. The dynamic and expressive portrayal of figures, especially the female form in Lara’s works, adds a layer of emotional resonance to these pieces.

A Gateway to Innovation and Potential Returns

Investing in Neophotorealistic art is not just about acquiring visually stunning pieces; it’s an entry into the realm of artistic innovation. As collectors embrace this emerging trend, there is the potential for these unique artworks to appreciate in value, making them a distinctive addition to a diversified investment portfolio.

Why Consider Neophotorealistic Art?

- Innovation Meets Tradition: Neophotorealism represents the fusion of photography and traditional oil painting, offering a balance between innovation and timeless artistic techniques.

- Limited Availability: As a relatively new and unique approach, Neophotorealistic artworks may be rarer in the market, potentially increasing their desirability among collectors.

- Artist Recognition: With Raúl Lara at the forefront of this movement, investing in Neophotorealistic art means aligning with the vision of an artist gaining recognition for pushing the boundaries of artistic expression.

In the ever-evolving landscape of art investment, Neophotorealism emerges as a compelling and distinctive choice for those seeking not only aesthetic pleasure but also the potential for financial appreciation. As you consider your art investment strategy, explore the allure of Neophotorealistic art—a captivating blend of innovation and tradition that could redefine the future of art collection and investment.

Raúl Lara´s Neophotorealistic Art Collection

2

1.350,00$Aes argentumque

2.200,00$Alba Magma

1.150,00$Alter ego

2.700,00$ iva incuidoAmplecti Animam

2.500,00$Amplexus

1.300,00$Angelus

2.500,00$Animo

2.590,00$Arbitrum

1.590,00$

Conclusion

In the grand tapestry of investment opportunities, art holds a unique and vibrant thread. As we conclude our exploration, remember that art isn’t just a financial asset; it’s a testament to human creativity, history, and cultural evolution. Consider the brushstrokes of art in your investment canvas, and embark on a journey that combines financial acumen with aesthetic appreciation.

Ready to start your art investment journey? Begin by exploring galleries, attending auctions, and immersing yourself in the captivating world of art. Your collection awaits, promising not just financial growth but a visual feast for the soul.

FAQs

1. **What types of art have shown historically high returns as investments?**

– Art forms such as contemporary paintings, sculptures, and photography have demonstrated significant appreciation in value over time.

2. **How do I ensure the authenticity of an artwork before making a purchase?**

– Thoroughly research the artist, seek provenance documentation, and if necessary, consult experts or appraisers to verify authenticity.

3. **Can I include digital art in my investment portfolio?**

– Absolutely. Digital art has gained traction in the market, and platforms like NFTs (Non-Fungible Tokens) have opened new avenues for investing in this realm.

4. **Are there tax implications associated with art investments?**

– Yes, there can be tax considerations. It’s advisable to consult with financial advisors or tax professionals to understand the tax implications of your art investments.

5. **How often should I reassess the value of my art collection?**

– Regular reassessment is advisable, especially when significant market shifts occur. Stay informed about art market trends and reassess the value of your collection accordingly.